Money has always been the biggest motivator for cybercriminals to access user data. In today’s digital age, cybersecurity is paramount for all businesses, but cybersecurity in the financial industry is especially critical. Financial institutions hold vast amounts of sensitive customer data, making them prime targets for cyberattacks.

With the potential for devastating financial losses and reputational damage, it is essential for financial institutions to take proactive measures to protect their systems and data.

The Ever-Growing Threat Landscape

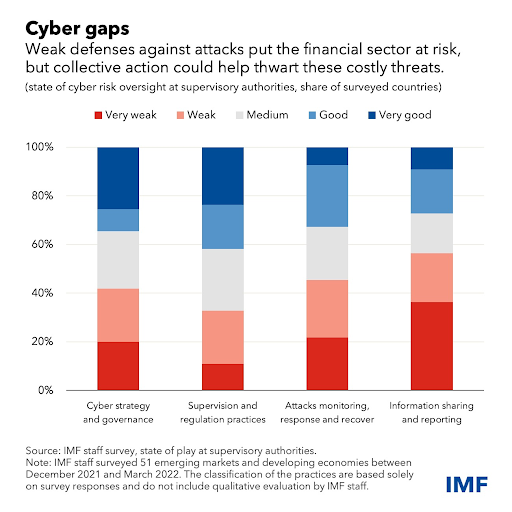

Fig. 1: Risk factors in the digital ecosystem of the financial sector

Image credit: IMF (Source)

The cybersecurity threat landscape is constantly evolving, with new and sophisticated attack methods emerging all the time. Cybercriminals are increasingly targeting financial institutions, recognizing the potential for high-value rewards.

In recent years, there have been several high-profile cyberattacks against financial institutions, including the Equifax breach in 2017 and the SolarWinds hack in 2020. These attacks have caused significant financial losses and reputational damage, and they highlight the need for enhanced cybersecurity in the financial industry and for financial institutions to remain vigilant.

Taking Action to Protect Financial Institutions

Financial institutions can take several steps to protect themselves from cyberattacks. Some of the most important steps include:

- Implementing strong security controls

- Educating employees about cybersecurity best practices

- Conducting regular security audits and penetration tests

- Having a robust incident response plan in place

Threats of Having a Weak Cybersecurity Posture

Here are some of the dangers that weak cybersecurity poses to financial enterprises.

Malware

It is software that is designed to harm a computer system and can be used to steal data, corrupt files, or take control of a system.

Phishing

It’s a type of social engineering attack that tries to trick people into giving up their personal information, such as passwords or credit card numbers.

Ransomware

It is a type of malware that encrypts a computer system’s files, making them inaccessible until a ransom is paid.

Denial-of-service (DoS) attacks

DoS attacks are designed to overwhelm a system with traffic, making it unavailable to legitimate users.

Zero-day attacks

Zero-day attacks are attacks that exploit vulnerabilities that are not yet known to the software vendor.

Cyber Threat Challenges in the Financial Industry

If a financial institution doesn’t implement the best practices of cybersecurity in the financial industry, it risks falling prey to dire repercussions.

- Increased risk of financial fraud: Financial institutions hold vast amounts of sensitive customer data, including account numbers, credit card information, and social security numbers. A weak cybersecurity posture makes it easier for cybercriminals to steal this data and use it to commit financial fraud, such as identity theft, credit card fraud, and online banking scams.

- Reputational damage and loss of customer trust: A cyberattack on a financial institution can cause significant reputational damage, erode customer trust, and lead to a loss of business. Customers may be reluctant to do business with a financial institution that has been hacked, even if they were not directly affected by the attack.

- Legal and regulatory fines: Financial institutions are subject to a variety of laws and regulations that require them to protect customer data. A weak cybersecurity posture can make it more difficult for them to comply with these regulations, and could lead to fines or other penalties.

- Disruption of operations: Cyberattacks can disrupt the operations of financial institutions, causing outages, delays, and customer inconvenience. This can have a negative impact on the bottom line and make it difficult for financial institutions to meet their service level agreements.

The Solutions

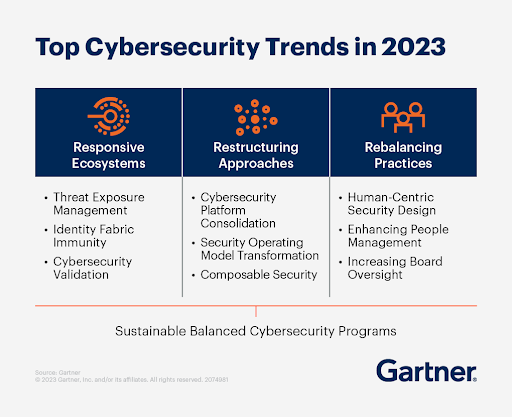

Fig. 2: Primary ways to counter sophisticated cyber threats

Image credit: Gartner (Source)

As part of the measures for cybersecurity in the financial industry, financial institutions should implement strong security controls, such as firewalls, intrusion detection systems, and access controls. These controls can help to prevent cyberattacks from reaching sensitive systems and data.

Employees are often the weakest link in the cybersecurity chain. They can unwittingly click on malicious links, open infected attachments, or provide their personal information to scammers. Financial institutions should provide regular cybersecurity training to their employees to help them identify and avoid phishing attacks, malware, and other online threats.

Regular security audits can help to identify and fix vulnerabilities in a financial institution’s systems and infrastructure. Penetration tests can also be used to simulate cyberattacks and assess the effectiveness of the institution’s cybersecurity defenses.

Even the most secure financial institutions will eventually be attacked. Having a robust incident response plan in place can help to minimize the damage and disruption caused by a cyberattack. The plan should include procedures for identifying, isolating, and remediating the attack, as well as procedures for communicating with customers and the media.

Final Thoughts

By taking these steps, financial institutions can significantly improve their cybersecurity posture and reduce their risk of cyberattacks.

In addition to the above, financial institutions should also consider adopting a zero-trust approach to security. A zero-trust approach assumes that no user or system is inherently trustworthy and that every access attempt must be verified and authorized. This approach can help make it more difficult for attackers to gain access to sensitive data or systems.

Cybersecurity in the financial industry is an ongoing challenge, as cybercriminals are constantly innovating new attack methods. However, by taking proactive measures, adopting a comprehensive cybersecurity strategy, and a cyber-expert partner like STL Digital, financial institutions can significantly reduce their risk of cyberattacks.